The 360-degree Business platform in China

Connect and succeed at German Centre Beijing

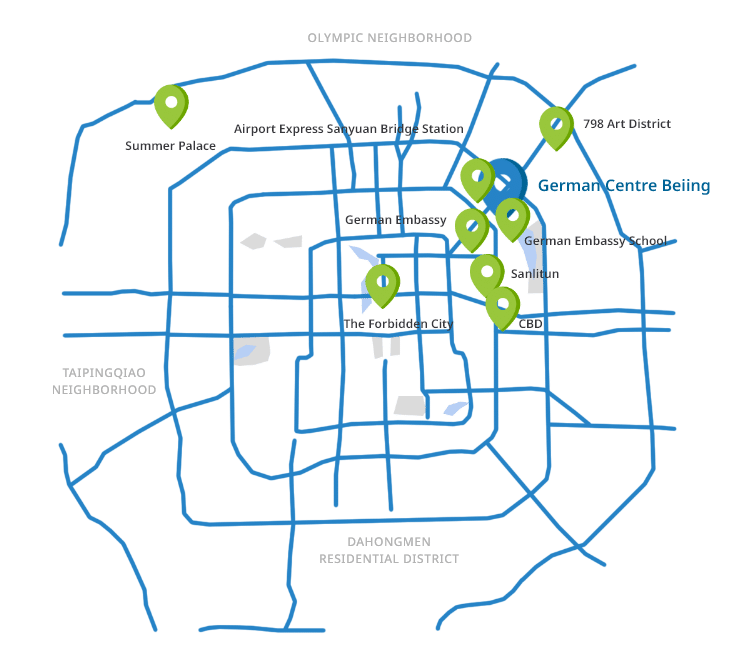

German Centre Beijing is more than just an office building with modern workspaces. Benefit from a unique ecosystem of more than 70 German companies and key organizations under one roof. Located in the middle of Beijing, we provide a 360-degree platform for your business success in China.

Market Opportunities

Good reasons to set up your office here

Modern Office Spaces

Prime Location

Networking and Exchange

Market Exposure & Know-How

In-house Business Services

Home for innovative Industries

Your Benefits

Specialities for this location

Growth industries and market trends

Each year the German Centre Beijing puts the spotlight on certain growth industries, shares insights on latest market developments in China, and provides a platform for exchange of best practices. In 2023, our China MedTech seminar series introduces the latest trends in the dynamic and innovative MedTech sector with insights from top industry innovators and thinkers. Join us to find out about the opportunities for German MedTech companies in China and better understand the challenging market conditions of a changing regulatory environment and increasingly competitive landscape.

Spaces

The ecosystem for your business

A modern Workplace

Office Spaces at German Centre Beijing

Services & Stories

What moves our clients and ourselves

Established

More than

About

Hosted

Over

Contact

Get in Touch

Would you like to learn more about us, our offices, networks and services? Contact us, we are looking forward to getting to know you.

News & Events

What’s happening at German Centre Beijing?

Maurice Lauber is new Managing Director of German Centre Beijing

Maurice Lauber is the new Managing Director of the German Center Beijing.

IWD breakfast event: Women in management positions

Nehmen Sie mit uns an unserem Frühstücks-Networking-Event am 8. März teil und erleben Sie einen Vormittag der Stärkung.

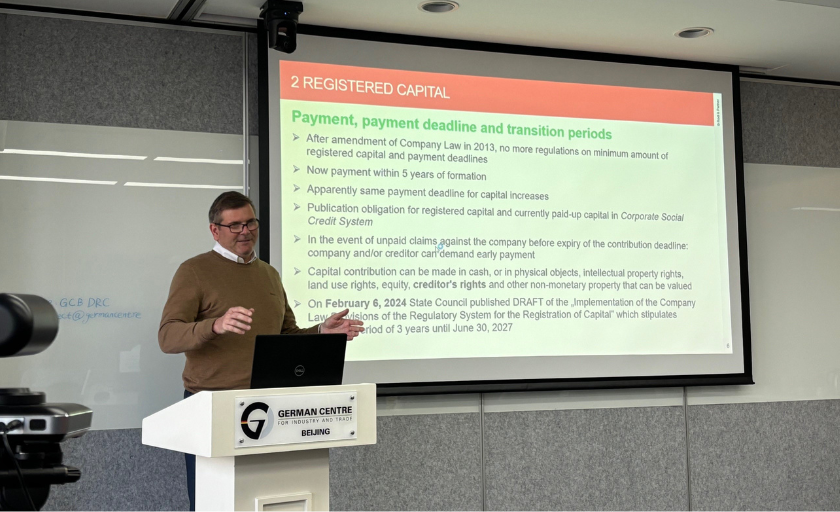

Review: Main Changes of the New China Company Law

Sebastian Wiendieck, lawyer and partner of Roedl & Partner China, shed lights on the key changes of the new Company Law and shared recommendations for action to companies.